19/09/2019 – Ethiopia — auf Deutsch lesen

Growing textile sector supports cotton production

The textile and apparel industry provide a significant source of income and employment in many countries. But in Africa, there is often still a lack of necessary structures.

According to the International Cotton Advisory Committee in sub-Saharan Africa, cotton-producing countries export about 90 percent of their fibre. Cotton consumption has remained steady over the last two decades. Currently, Ethiopia, Tanzania, Nigeria and South Africa are the major cotton-consuming countries in sub-Saharan Africa. According to figures from the World Bank, from 2008–2017, exports of textiles and garments from sub-Saharan Africa only accounted for 2 percent of total export revenue, which reached US$212 b in 2017.

Role of the textile industry

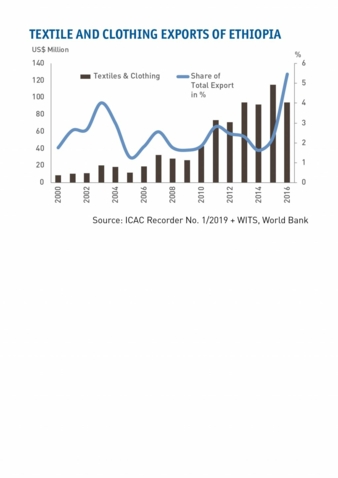

In recent years, governments in countries like Ethiopia — the second-most populous nation of the region — have encouraged diversifying their export revenues by driving key sectors, including textiles and apparel. In 2012, Ethiopia exported US$71.2 m of textiles and garments, a number that grew to US$ 94.1 m by 2016, a 32 percent increase. Similarly, textile and garment exports increased its share of total exports from 2.46 percent to 5.46 percent during the same period.

The textile sector is part of the Government’s Growth and Transformation Plan (GTP), which was established in 2010 and expanded in a second version, GTP II, with all the objectives set out for 2020. The purpose of this plan is transitioning Ethiopia from an agriculture-based economy. The textile-apparel industry is a significant element of the economy, in both financial and social terms, as it is a major source of employment and foreign exchange.

Foreign companies invest in industrial parks

The Ethiopian cotton sector currently meets 70 percent of the domestic industry’s raw material requirements. Cotton consumption in Ethiopia is expected to increase in coming years as a result of expansion in the textile industry due to foreign investment from countries such as China, India, and Turkey, among others. According to the Ethiopian Investment Commission (EIC), several foreign companies have committed to investing about US$2 b in industrial parks to accelerate textile production and garment manufacturing.

According to the Ethiopian Textile Industry Development Institute (TIDI), there are at least a dozen spinning mills in the pipeline to address some of the expected demand for yarn. These planned facilities, plus the 15 existing spinning mills currently operating, will bring the country’s installed annual processing capacity of lint cotton to 200,000 metric tons. (Source: ICAC)

Growing cotton consumption

For MY2019/20, the USDA Foreign Agriculture Service forecasts total cotton consumption levels to slightly increase to 295,000 bales (64,000 metric tons), up 20,000 bales or 4,000 metric tons compared to previous year. The increase is based on growing demand from existing and newly installed spinning mills and increased number of textile industry parks. The traditional handloom subsector is projected to show vibrant growth although the subsector mostly consumes cotton produced by smallholder farmers.

Investments in development

According to USDA FAS the Ethiopian government launched the New Cotton Development Strategy (NCDS), which laid out its plans for the coming 15 years (2017-2032) to make Ethiopia one of the world’s top cotton producers with annual cotton lint production of 1.1 million metric tons. To realize this vision, the NCDS proposes establishing the Ethiopian Cotton Development Authority to oversee and implement plans to make the cotton sector more competitive. From the USDA Post’s perspective, the NCDS production target seems out of reach in such a short time.

Expansion of cotton area

MY 2019/20 cotton production in Ethiopia is forecast at 262,000 bales or 57,000 metric tons, up by eight percent from the previous year’s production estimate. The forecast is based mainly on anticipated expansion of cotton area harvested from 77,000 hectares to 80,000 hectares. As the price of sesame seed plummeted on the international market, producers showed stronger preferences to plant cotton mainly in the northern and northwest regions. Many farmers switched to production of cotton with expectation of better price returns.

Flawed market conditions

Despite good harvests in 2018/19, farm labor availability has continued to pose serious challenges to private commercial cotton farms. Cotton production has a considerable potential to increase if the existing flawed market conditions are improved. Among these, reliable market information and proper market linkages between cotton producers (smallholder, large-scale commercial farmers, coop unions), ginneries and textile mills.

Ethiopia approved commercialization of Bt cotton in order to boost yields and production. About 800 hectares of land is planned for Bt cotton plantings as a trial production.

Sources: USDA Gain Report Ethiopia 06/2019, ICAC Recorder No. 1/2019