25/04/2022 – Japan — auf Deutsch lesen

Lowest cotton imports since World War II

Due to the tense economic circumstances in Japan, the situation for the textile industry there remains difficult. This also applies to cotton imports.

In 2020, Japan’s economy, which had turned negative growth with the consumption tax hike implemented in October 2019, and natural disasters such as heavy rains and earthquakes in 2019, has worsened further, mainly due to the spread of Covid-19 infection and self-restraint requests to refrain from going out unnecessarily for a long time.

In the face of this general situation of the economy, the environment surrounding Japan’s textile industry continues to be very severe with shrinking domestic demand for textile goods. The continued increase in cotton yarn imports, coupled with the stagnant domestic demand for cotton products, the markets deteriorated, making things difficult for the spinning industry. As a result, the continuing sluggish demand forced the spinning industry to reduce spinning equipment.

In 2020, the production of the cotton yarn decreased by 32% to 21,300 tonnes in Japan. The 2020 domestic spinning capacity of all types totaled 781,000 spindles, 7% below the previous year.

Japan’s spinners continue relocating their spinning capacities to overseas joint-venture textile mills. At this time, a total of 719,000 spindles are estimated to operate in joint venture mills that include 405,000 spindles in Indonesia, 74,000 spindles in Thailand and 121,000 spindles in Brazil.

Low demand and Covid-19 slow down cotton imports

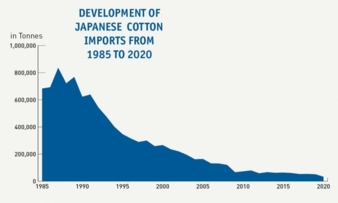

2020/21 Japan’s cotton imports totaled 31,570 tonnes, 34% below 47,790 tonnes in 2019/20, primarily due to stagnant demand and disruption caused by the Covid-19 pandemic. This is the lowest level of cotton imports after World War II. Prior to the Covid-19 outbreak, Japan’s import demand was relatively strong, but it slowed sharply thereafter.

The main sources of supply were the United States, followed by Greece, Australia and Brazil. Imports of U.S. cotton used mainly for spinning medium count yarn decreased by 39% to 16,300 tonnes. Nonetheless, U.S. accounted for 52% of total imports and remains the largest supplier. Australian cotton fell to 3,700 tonnes, down 45% from last season. On the other hand, Greek cotton for medium/coarse count yarn production declined by 4% to 5,400 tonnes. Similarly, Brazilian cotton used for medium/ coarse count yarn decreased by 45% to 2,800 tonnes. In contrast, Turkish cotton such as Organic Cotton expanded by 125% to 1,500 tonnes.

The United States, Australia, Greece and Brazil account for over 90% of total imports of Japan in recent years, which suggest that oligopoly is on the rise. For 2020/21, these top four countries accounted for 89%.

Expectation: More demand for the natural fiber cotton

While the Covid-19 pandemic spurred a decline in cotton imports, there are growing expectations that demand for cotton as a natural material will be stimulated by SDGS and the heightened casual orientation.

In the wake of World War II, Japan’s textile sector grew quickly over the next several decades, along many other industries, but later entered into a decline. At its peak, Japan’s spinning sector represented 6% of world consumption, but now represents less than half of a percent of that total.

Mill use in Japan has leveled to around 54,430 tonnes in recent years. For 2020/21, consumption decreased to 31,600 tonnes, mainly due to a stagnant demand and disruption caused by Covid-19 pandemic as well.

Source: The Japan Cotton Traders’ Association: The Japan Cotton Statistics and Related Data 2021

Bremer Cotton Exchange – Bremen Cotton Report No. 11/12 2022